The implementation of GASB 87’s evil twin, GASB 96 Subscription-Based Information Technology Agreements (SBITAs), is finally here. In the lead up to fiscal year-end 2023, we’ve received some common questions from our staff, clients and peers.

Whether you’ve been eagerly awaiting it or dreading it, the implementation of GASB 87’s evil twin, GASB 96 Subscription-Based Information Technology Agreements (SBITAs), is finally here. In the lead up to fiscal year-end 2023, we’ve received some common questions from our staff, clients and peers. Here’s what we’re being asked:

Are we calling them Suh-Bitas or Suh-Beetas?

This one is fielder’s choice. You can call it whatever you like, it unfortunately doesn’t change the accounting treatment or the implementation date of the statement.

If I have a 12-month SBITA with a renewal option for subsequent terms that is reasonably certain to not be exercised, is this a short-term SBITA?

No, per Paragraph 13 of GASB 96, a short-term SBITA is a SBITA that has a maximum possible term of 12 months, including any options to extend, regardless of their probability of being exercised. The 12-month SBITA with a renewal option for subsequent terms that is not reasonably certain to be exercised would qualify for capital treatment under Paragraphs 9-12 of GASB 96 and would require governmental entities to record a right to use asset and a subscription liability that would be amortized over the 12-month period per Paragraphs 15, 27, and 59. Per Paragraph 14 of GASB 96, the short-term SBITA payments should be recorded as an outflow of resources as the expense/expenditure is incurred.

We sometimes get better pricing for prepaying long term SBITAs. What happens if I prepay all or a portion of a long-term SBITA? What does the accounting look like?

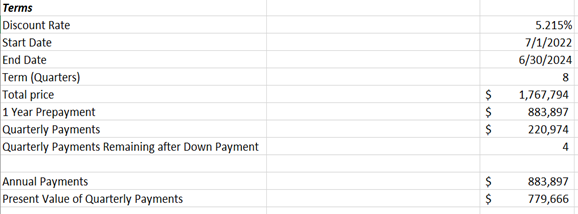

Let’s take a look at an example so we can follow the journal entries from the fund level to the government-wide statements. The fact pattern below summarizes a SBITA with a 1-year prepayment and 4 quarterly payments due in arrears during the second and final year.

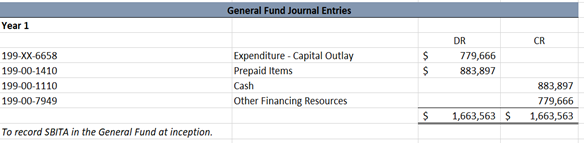

At inception of the SBITA, we’ll need to record the following at the fund level:

We then need to amortize the prepaid at the fund level during Year 1:

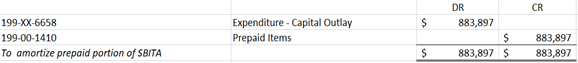

What about the government-wide entries?

Note that the prepayment of the SBITA was considered an asset at the fund level and reclassified to a right-to-use asset at the government-wide level consistent with Paragraph 26 of GASB 96. See below:

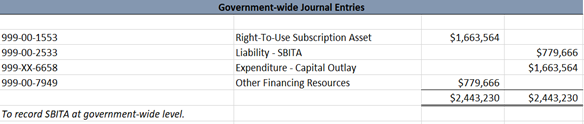

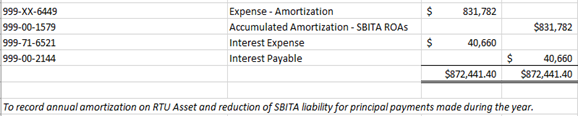

We’ll then need to amortize the right-to-use asset and relieve any payments made against the SBITA liability:

Note that since there were no payments due during Year 1 of the SBITA, we just accrued interest on the subscription liability.

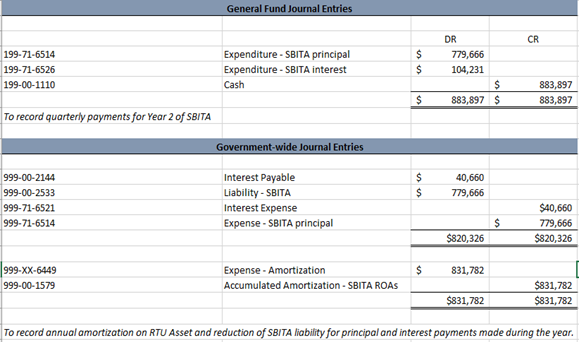

The Year 2 payments will be applied to principal and interest accordingly consistent with Paragraph 19 of GASB 96. See below:

If both parties can cancel due to breach of contract, does that make the agreement cancellable and therefore NOT a SBITA?

No. The cancellation clause has to be due to convenience. Although this is the guidance for leases, this can also be applied to the evil twin, SBITAs:

Termination for cause doesn’t make it cancellable, so all things constant, this one is a SBITA. Please see GASB No. 99 Omnibus 2022, Paragraph 11. Omnibuses in GASB are corrections or clean-up language. See below:

For purposes of applying paragraph 12 of Statement 87:

An option to terminate is an unconditional right that exists within the lease contract. A provision that gives a lessee or lessor the right to terminate the lease only in certain circumstances or upon the occurrence of certain events, such as the action or inaction of the other party to the lease contract, should not be considered an option to terminate the lease for purposes of determining the lease term. For example, provisions that allow for the termination of a lease due to a violation of lease terms and conditions, such as a default on payments, are not considered options to terminate the lease.

When applying my recognition threshold do I evaluate the annual payment noted in the SBITA?

No, assuming that the agreement meets all of the requirements of GASB 96 (greater than 12 months, noncancellable and doesn’t transfer ownership), then the present value using the term of the agreement needs to be used.

As we get closer to fiscal year-ends and as most begin or continue to dig into the details of their SBITAs, we’ll likely see additional frequently asked questions surface. Don’t hesitate to ask a trusted resource should you encounter issues when implementing GASB 96. It’s likely that someone else is encountering the same or similar issue.