China’s solar panel industry faces a year of reckoning amid global protectionism, slowing demand at home

Chinese suppliers of solar panels could be facing an epic headwind in the year ahead, as rising production capacity is set to coincide with a downturn in domestic demand and growing trade protectionism that threatens access to the US and promising emerging markets such as India.

China exported 37.9 gigawatt (GW) of solar panels last year – equivalent to 37 per cent of global solar installation – up 78 per cent from 2016, according to China Photovoltaic Industry Association data.

The Chinese solar manufacturing industry – which last year accounted for 55 to 83 per cent of global supply of products ranging from raw material polysilicon to solar panels – will have to brace for hard times, analysts said.

Access to the US market has come into question since the Trump Administration announced a 30 per cent tariff on solar panel imports from China, while India has discussed a 70 per cent duty, threatening access to the world’s second most populous market.

“We believe a down-cycle and de-rating of China’s solar sector is likely to happen in 2018,” said Daiwa Capital Markets in a recent report. “China’s solar upstream market is set for significant oversupply from 2018.”

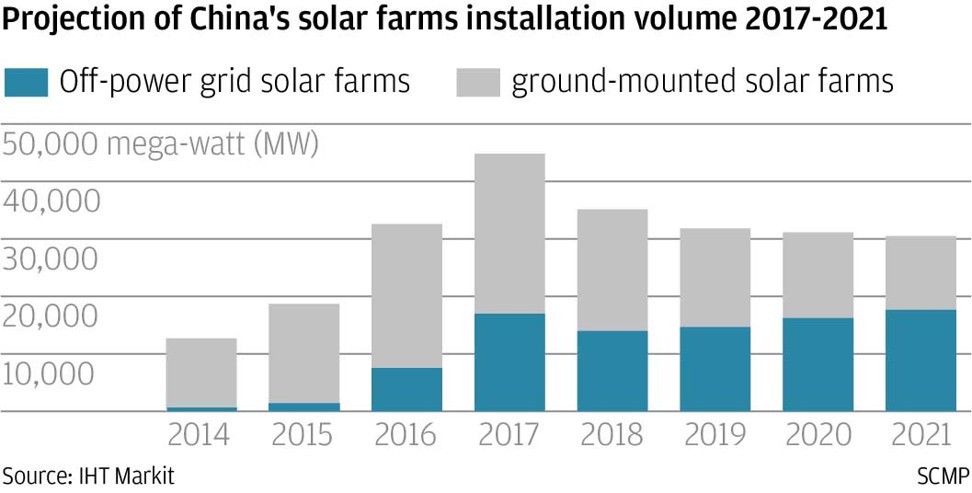

Daiwa said it expects a profits squeeze at solar panel makers as domestic installation demand this year falls to 45GW from 53GW last year, while solar panel production capacity rises 10 to 20 per cent across the supply chain.

Frank Haugwitz, founder of Asia Europe Clean Energy (Solar) Advisory, also projected 45GW of new capacity in China this year, while industry information and analytics provider IHS Markit senior analyst Jessica Jin Feng indicated domestic installation of at least 50GW.

Sun Xingping, president of debt-laden GCL New Energy, one of China’s largest solar farms operators, told reporters on Friday he expected the national installation volume to drop to between 40GW to 45GW this year and 35GW to 40GW next year, adding that the company plans to commission 1GW to 1.5 GW this year, down from 2.5GW last year.

He said the cut back will help lower its total liabilities-to-assets ratio to 80 per cent from 84 per cent last year. The company is in talks to set up a fund with several potential investors to take over some of its solar farms and help lighten GCL’s debt load.

A surge in newly commissioned global production capacity by 20 per cent amid a demand slowdown could see solar wafer prices fall 15 to 20 per cent this year, Daiwa analysts said.

Declining wafer prices during the past decade have supported demand growth. However, analysts say that this year’s projected demand drop in China, the US and India – the top three markets – may squeeze profitability of companies slow to implement cost reductions, especially those without an in-house supply of polysilicon.

The three markets are forecast to take up 60 per cent of global demand, accounting for 108GW this year, according to IHS estimates.

If the forecast is realised, it would imply a marked slowdown in global panel demand growth to around 8 per cent from 30 per cent last year.

Meanwhile, China’s panels exports to emerging markets such as India, Mexico and the Middle East has been rising steadily in recent years.

Frank Yu, an Asia-Pacific power and renewable energy principal consultant at consultancy Wood Mackenzie, said Chinese companies could redirect some sales to Asian markets to offset the impact from US tariffs in the near term.

The US is likely to install around 10GW of solar panels this year, compared to 11GW in 2017 and 16GW in 2016, according to IHS estimates.

Jin said it is not clear whether the duties imposed by Washington will be sufficient to induce Chinese manufacturers to set up solar panel plants in the US. The cost advantage is not clear, as the 30 per cent import duty is set to fall by five percentage points each year before reaching 15 per cent in 2021 and details are limited on the exemption of 2.5GW of annual imports, he said.

“There has been speculation that several Chinese companies may set up shop in the US, but the math is not clear whether they might be better off using their plants in Southeast Asia to export to the US and pay the duties,” Jin said.

“Given the troublesome environmental impact assessments involved in setting up a plant in the US, if China’s solar panel demand stays strong, chances are they may not build factories in the US.”

Last year the amount of new power capacity at solar farms in China overtook annual new capacity at coal-fired power plans for the first time. China’s solar installations added 53GW worth of power generation capacity in 2017, an increase of 54 per cent from 2016, and exceeding coal-powered capacity growth of 38.6GW.

It was the fifth consecutive year that China’s solar installation was world-leading, and the third year in a row that solar expansion exceeded market expectations.

Analysts have expressed concern whether the growth rate can be sustained, citing financing constraints, power grid capacity shortages and arrears in government subsidies.

“Accurately forecasting China’s annual solar [panels] demand is and will remain a challenge in the future,” said Haugwitz. He said last year’s record volume saw analysts adjusting their full-year forecast as many as half a dozen times as the year progressed.

China surpassed its 2020 target of 105GW mid last year, some three and a half years ahead of its goal announced late 2016.

The expansion meant a third of the world’s installed solar power capacity is located in China, and solar has moved up another position to become the fourth largest source of the nation’s power generation by capacity, making up 7.2 per cent of the total.

However, due to the much lower utilisation rates of solar farms relative to the mainstay coal-fired plants, solar farms contributed only 1.9 per cent of the nation’s total power output.

Solar is likely to overtake wind for the No 3 spot in terms of capacity by the end of the year, Haugwitz said.

Together with hydro plants and wind farms, the total new capacity addition from the three forms of renewable energy surpassed that of coal and natural gas for the first time in 2016.

If nuclear plants are also included as a source of clean energy, fossil fuel-fired electricity capacity addition was already eclipsed by clean energy in 2015.

The falling production costs of wind and solar energy have sparked speculation that one day the renewable energy sources will be able to compete with fossil fuel sources without government subsidies.

Some onshore wind farms in China were awarded to developers on a subsidy-free basis last year, with their power tariffs matching or undercutting those of coal-fired plants.

The so-called “grid parity” tariffs, where renewable energy and coal-fired energy are equally competitive on a same tariff basis, work for only for a small but growing portion of all projects.

Industry wide competitiveness of power generated from renewable sources versus fossil fuels are still years away.

“Despite recent [technological] advances, grid parity for major renewable energy sources is still several years away for most countries,” said a recent report by Lloyd’s Register.

“The industry expects parity for solar [farms] to be achieved earliest in China – by 2022 or 2023, and for wind [farms] earliest in Germany in 2024.”

However, even when a tipping point is reached several years down the road on the project level, the report pointed out that more support is needed “to tilt the energy balance decisively in renewables’ favour”.

Insufficient power grid transmission capacity and a lack of cost-efficient energy storage infrastructure “limit the impact of individual projects,” by keeping utilisation of wind and solar farms at relatively low levels, it noted.

This can be mitigated by further technological innovation that reduces the infrastructure and running costs of wind and solar farms.