What Is Actuarial Science?

Actuarial science is a discipline that assesses financial risks in the insurance and finance fields, using mathematical and statistical methods. Actuarial science applies the mathematics of probability and statistics to define, analyze, and solve the financial implications of uncertain future events. Traditional actuarial science largely revolves around the analysis of mortality and the production of life tables, and the application of compound interest.

KEY TAKEAWAYS

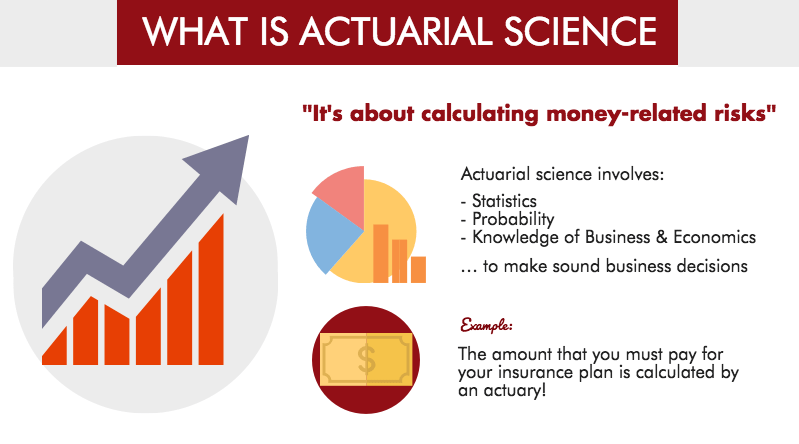

Actuarial science assesses financial risks in the insurance and finance fields, using mathematical and statistical methods.

Actuarial science applies probability analysis and statistics to define, analyze, and solve the financial impact of uncertain future events.

Actuarial science helps insurance companies forecast the probability of an event occurring to determine the funds needed to pay claims.

The Casualty Actuarial Society (CAS) and Society of Actuaries (SOA) promote several professional certifications for actuaries to pursue beyond a bachelor's degree in actuarial science.

The most recent salary information from the Bureau of Labor Statistics shows actuaries earned an average salary of nearly $113,990 as of May 2022.1

Understanding Actuarial Science

Actuarial science attempts to quantify the risk of an event occurring using probability analysis so that its financial impact can be determined. Actuarial science is typically used in the insurance industry by actuaries. Actuaries analyze mathematical models to predict or forecast the reasonableness of an event occurring so that an insurance company can allocate funds to pay out any claims that might result from the event.2 For example, studying the mortality rates of individuals of a certain age would help insurance companies understand the likelihood or timeframe of paying out a life insurance policy.

Actuarial science became a formal mathematical discipline in the late 17th century with the increased demand for long-term insurance coverage. Actuarial science spans several interrelated subjects, including mathematics, probability theory, statistics, finance, economics, and computer science.3 Historically, actuarial science used deterministic models in the construction of tables and premiums. In the last 30 years, science has undergone revolutionary changes due to the proliferation of high-speed computers and the union of stochastic actuarial models with modern financial theory.

Applications of Actuarial Science

Life insurance and pension plans are the two main applications of actuarial science. However, actuarial science is also applied in the study of financial organizations to analyze their liabilities and improve financial decision-making. Actuaries employ this specialty science to evaluate the financial, economic, and other business applications of future events.