Is sudden appreciation of AFN against USD posses a concern?

The exchange rate plays a significant role in every economy in terms of purchasing power, international trade competition and socio-economic. The exchange rate means the price of one currency (domestic currency) in terms of another currency (foreign currency). When it comes to exchange rates, everyone needs to be familiar with four terms, (appreciation and depreciation) and (revaluation and devaluation). Appreciation indicates a rise in the price of domestic currency in terms of foreign one while depreciation the latter means exactly the opposite case due to the market forces. Revaluation and devaluation indicate the same mechanism but under this mechanism, the government deliberately revalues and devalues the domestic currency due to the economic and international trade position of the country.

The Central Bank of Afghanistan as the responsible body for conducting monetary policy in Afghanistan uses managed floating exchange rate system to control the price of AFN(Afghani) against foreign currencies. In principle, under such system such system, the value of AFN is mainly determined by the market forces, supply, and demand, and the responsible body intervenes from time to time to keep the exchange rate within the targeted range. The Central Bank of Afghanistan intervenes in the market mainly by auctioning USD in the market as deemed necessary.

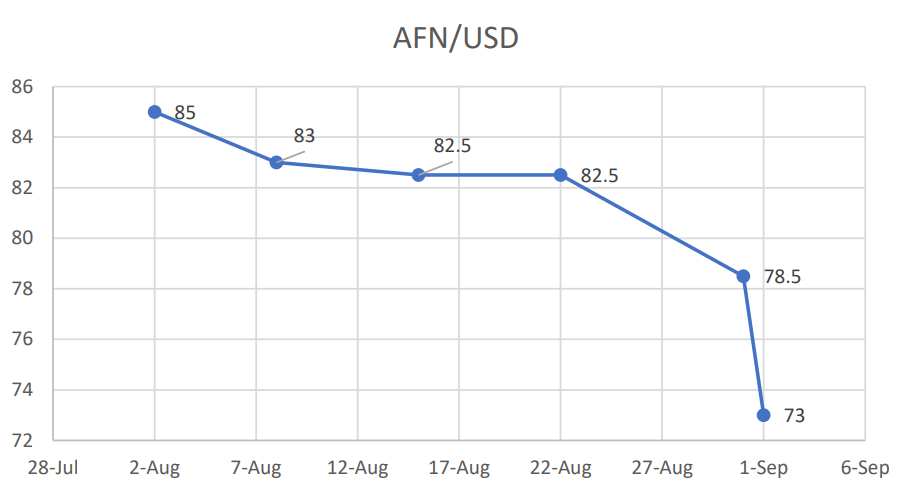

After the political development of 2021, the price of AFN fluctuated dramatically, reaching to 130 AFN/USD as the future of politics, security and economy was dark. Subsequently, the exchange rate dropped to 90 AFN/USD. For the long period, the exchange rate of AFN/USD was around 85 AFN/USD in the domestic market of Afghanistan. However, during August 2023, last month, the Afghani appreciated markedly against the USD in particular and all other currencies in general. Within one month, particularly after 15 August, the price of AFN in terms of USD dropped from 85 AFN to 73 AFN, indicating almost 15% appreciation.

Theoretically speaking, international trade stand and monetary policy mainly determines the exchange rate when it comes to managed floating system. Under this dynamic, both process, appreciation and depreciation process adjusts themselves gradually. However, in a country like Afghanistan with high dollarization, a sudden appreciation of domestic currency holds various reasons.

First, despite the country’s foreign reserve having been frozen by the FED, the country has received 45 million USD on a weekly basis since August 2021 as part of the international communities’ commitment to fight the humanitarian crisis in Afghanistan. According to the World Bank, as of August 2023, the aggregate figure of humanitarian aid amounted 3 billion USD. The inflow of USD has been stabilized the exchange rate market automatically because some portion of them distributed as cash transfers and paid the salaries of UN and UN-related employees.

Second, the remittance played a significant role in the appreciation of the Afghani. According to the official data, Afghanistan has received around 1.6 billion USD since 2020 in the form of remittances. When individuals send money from abroad, it is typically in the currency of the host country. When this foreign currency is converted into domestic currency (through the foreign exchange market), it increases the supply of domestic currency in the market. An increase in the supply of a currency can put upward pressure on its value or exchange rate.

Third, the usage of foreign currencies for daily transactions has been banned in Afghanistan, particularly in bordering cities with Pakistan and Iran. Usage of AFN in those cities raised the demand for AFN and this puts pressure on the value of AFN to rise in terms of other foreign currencies. Besides, there is a strict regulation forwarded by the government on transferring USD with the country, particularly in cash. Likewise, the smuggling of dollars into neighboring countries has been controlled.

Furthermore, the economy of the country reaching a new equilibrium, where demand for foreign currency declining due to political development, exclusion of the domestic financial market from the international financial environment, and control of the money supply by the Central Bank of Afghanistan. All these together triggered to increase in the stock of USD in the domestic market; at the same time, demand for the AFN rose due to the money supply control. All these interacted together and caused the AFN to appreciate markedly within a month again major foreign currency.

Economically speaking, the appreciation of domestic currency is viewed a positive sign that the country is enjoying a relatively stable balance of payment and low inflation. As mentioned appreciation of domestic currency increases the purchasing power of domestic households as well as increases the profitability of domestic firms. In Afghanistan, the domestic commodity market still did not adjust to this exchange rate appreciation, still, households purchase basic needs at almost similar prices as previously. The dangerous concern is that if this appreciation occurred due to the shortage of AFN in market, if it is so, the citizen pays the price. This is because Afghanistan is an export-dependent country with a balance of payment deficit of around 85% and households will not feel the currency appreciation in the market. Furthermore, if it is so, the appreciation may not increase the Purchasing power of households; partly because of the trade deficit and partly now the household exchanges the received remittance with lower AFN but buys at the same price as previously. So, let's wait for the commodity market.