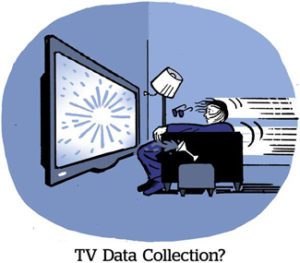

The more the TV industry rallies around new video currencies, the more programmers and advertisers are zooming in on automatic content recognition (ACR) as a must-have data set for measurement and targeting.

ACR tracks TV viewership on devices through software that’s loaded on just about every smart TV. Once ACR decodes what a TV is watching and when, advertisers can use that data to understand their audiences better. And since TV fragmentation is only getting worse with more and more ways to watch content, buyers are leaning on ACR for more consistent measurement.

From a measurement standpoint, ACR serves as a “normalizer” of TV impressions, providing valuable insight for buyers on where and when viewers are exposed to their ads, said Mike Fisher, executive director of investment innovation at GroupM.

Fresh, hot buy-side demand for ad exposure data is why content distributors and measurement providers are getting their mitts on as much ACR data as possible.

But ACR isn’t a data set without downsides. Despite opt-ins, the idea of ACR can feel creepy to consumers, meaning it walks on privacy eggshells. And it’s also got its own fragmentation problem, because it’s hard to aggregate data sets from different smart TV manufacturers.

So how does ACR actually work? Is it creepy? And what should advertisers and publishers keep in mind to use it effectively?

The 411 on ACR

At its simplest, ACR is software that identifies TV titles by analyzing screenshots of the TV.

ACR is integrated within a TV’s operating system, where it captures frame-by-frame screenshots of content. ACR ingests pixels on-screen to assign a value to each frame, which is considered an “unknown fingerprint” at this stage, explained Charbel Makhoul, GM of Inscape, Vizio’s data science branch. The software then sends these “fingerprints” to a database that logs content available on TV to find a known match and identify the content.

Once ACR identifies the show, it can tie that viewing data to a specific household, such as a given household watching “The Big Bang Theory” at 9 p.m. Vendors then use the patterns deduced from that viewing data to create audience segments of their own or license it to third parties. (Or both.)

ACR can capture all types of viewing on a TV, from linear TV to gaming. The granularity of viewing behaviors at the household level makes ACR a useful data set for retargeting on other channels, said Alex Reeder, VP of data innovation and research at Havas Media, which uses Samba TV’s ACR data set. For example, if a TV network has a new show coming out starring an A-list comedian, they could try to target ads to people who watched that comedian’s sitcom.

In the case of ACR, fingerprinting refers to the fact that a snippet of content helps identify the whole show being watched (and there is no relationship to the frowned-upon technique of device fingerprinting).

ACR tracks a TV set’s viewing, which isn’t PII, but once that viewing data is linked to a device ID for advertising purposes (which is the point), it could be tied to a unique household.

ACR’s way to comply with consumers’ data privacy concerns is to ask for consent.

A consent-based framework wasn’t always front and center, though. Just a few years ago, Vizio was one of a handful of content distributors sued for allegedly sharing smart TV owners’ viewing history without permission. In 2018, Vizio settled a class-action lawsuit for violating the 1988 Video Privacy Protection Act (VPPA), which prohibits providers from sharing viewing history without express consent.

What happened to Vizio is a “cautionary tale” for other ACR providers, said Ashwin Navin, CEO and co-founder of Samba TV.

After the settlement, Vizio rebuilt its ACR data-tracking model around consent. “Instead of just telling viewers that we were tracking them, we moved to an explicitly opt-in model on our smart TVs,” Inscape’s Makhoul said. (Inscape is the company that supplies Vizio’s ACR data.)

Since the settlement, Vizio users are no longer automatically opted in to data tracking as their default TV setting. When customers first set up their new smart TVs, Vizio asks viewers for consent to be tracked as part of the onboarding process.

The implications of Vizio’s settlement didn’t go unnoticed by other ACR providers. Opt-ins are required of any company collecting this kind of data.

Samba, for example, claims it prioritized user consent from the get-go. But since 2018, Samba added extra steps to remind customers of their right to opt out.

“Conditions have improved” for the industry to use ACR safely, said Andrew Frank, VP of research and distinguished analyst at Gartner. “But we’re not out of the woods yet.”

Why? Because there’s debate as to whether smart TV tracking opt-ins count as informed consent.

Compared with mobile pop-ups that ask people if they’d prefer apps not to track them, “smart TV menu options may not be so obvious,” said Gary Kibel, partner at law firm Davis and Gilbert. Smart TV opt-ins encompass several pages of terms and conditions that try to sell consumers on “personalized ads,” and changing user settings isn’t always that straightforward.

Narrowing the definition of informed consent would be the federal courts’ decision (if and when it happens). New privacy laws could also restrict the use of IP addresses by categorizing it as PII.

ACR’s privacy-safe status and the definition of what counts as PII are subject to change based on those factors.

View it or lose it

Since ACR checks the boxes on privacy for now, advertisers are using it to make better sense of where their TV ads are reaching audiences (and if viewers are even seeing the ads).

For one thing, ACR can address TV’s viewability problem since ACR only tracks impressions when a TV is actually turned on.

Advertisers can see “whether their ads actually hit the glass screen, which was never really possible before ACR,” said Kelly Abcarian, EVP of measurement and impact at NBCUniversal. “That verification piece is very valuable to buyers.”

ACR can also take linear TV measurement to the next level, Abcarian added, because the audience panels that linear campaigns still rely on can’t automatically detect whether an ad exposure occurred.

Viewability is an easy use case for ACR data. But with TV measurement in a complete state of flux, as streaming upends Nielsen’s measurement system, buyers are turning to ACR to solve for more than just viewability.

ACR data, for example, could theoretically give show-level transparency to impression-based CTV buys, which programmers have been reluctant to share due to VPPA concerns.

“We do see show-level transparency from some of the ACR vendors we work with,” GroupM’s Fisher said. That level of granularity is what buyers need to understand who has been exposed to their ads and where.

And for GroupM, modeling or aggregating ACR to understand exactly where CTV ads ran “doesn’t really do the job,” Fisher said, because it’s not exact. “Viewership measurement should not be left up to panels or probabilistic matching in an impression-based planning workflow.”

ACR data can also help advertisers figure out what content their ads are running next to, aka brand suitability.

Advertisers can work with ACR providers who categorize the genre of a show in addition to identifying the channel or program, helping advertisers understand if their ads are in places appropriate for the brand.

A measured approach

Buyers urgently need reliable and standardized TV measurement. That need is why video currencies building alternatives to Nielsen are using ACR to assert their place in the measurement race.

ISpot and VideoAmp both have deals with Vizio to use Inscape’s ACR data, for example. VideoAmp also licenses set-top box data, which, paired with ACR, is part of the company’s new measurement offering that lets advertisers compare viewership trends within a specific program. Samba TV also recently acquired an AI startup with access to content recognition data to filter more ACR into its measurement solution.

Nice. But not all of that ACR data is necessarily making it over to the buy side (not on a unique ID level, at least).

Picking up the pieces

The most urgent problem with ACR is the fact of fragmentation.

Content distributors like Samsung, Vizio, LG and Roku all offer advertisers rich volumes of ACR data. But they’re only executable within their own platforms.

At GroupM, “we do not believe that the ACR data sets of Samsung, Vizio, LG and Roku should be competitive with each other,” Fisher said. “To us, ACR is incremental exposure data that all needs to be brought into advanced planning workflows for targeting and measurement.”

If buyers can’t compare ACR across the board, then they can’t deduplicate audiences and they risk hitting the same households over and over instead of reaching new audiences.

But TV manufacturers are using their ACR data sets to encourage ad buys on their own platforms – not neutral measurement across other platforms. Vizio, for example, just built an audience panel using its own ACR data for targeting only on Vizio devices.

Vizio’s national representative panel (NRP) uses Inscape’s ACR to spot which population demos an advertiser’s campaign is underindexing on, such as, say, Black or Asian Americans. But Vizio’s panel uses only ACR from Vizio screens, so it wouldn’t be effective elsewhere, Makhoul told AdExchanger when Vizio rolled out its NRP in December.

Therein lies the rub with using ACR. If advertisers can only measure within a walled garden, not across one, they can’t compare how their ads performed on different channels. This lack of sharing could also hamper ACR data use as a currency.

Nearly every video currency is using ACR in some way, shape or form, GroupM’s Fisher said. But until all ACR data comes to live under one roof, advertisers may struggle to dedupe audiences across all screens.

GroupM is betting that it can break the walled garden approach by using clean rooms.

GroupM is focused on working directly with clean rooms owned by media sellers, such as NBCUniversal. And now the agency’s data and strategy division is currently having conversations with all of the major ACR providers about allowing ACR data to live within the privacy-safe guardrails of clean rooms, Fisher said. Within these safe spaces, buyers could match disparate ACR data sets without requiring a data provider to give up its competitive edge.

Vibe check

Within the current walled garden setup for ACR, advertisers should compare different ACR data sets to figure out which best meets their needs.

For example, buyers should check out ACR providers’ total household coverage, and whether a data provider has a comprehensive view of different devices within the same household.

LG, for example, insists that most consumers typically don’t have more than one smart TV model in the home, which makes its audience exclusive. But it’s certainly possible for a household to have multiple smart TVs of different models (especially given the fresh smart TV competition), which makes data muddier and access to a household less exclusive.

ACR isn’t perfect, Gartner’s Frank added, but neither is panel data. Overall, ACR is a “positive signal” from a measurement and targeting standpoint. “Having ACR is clearly better than not having ACR,” he said.

The TV industry seems to agree, since ACR is at the center of the industry shift toward alt currencies.

“ACR is one of the most important focal points for TV planning, buying and measurement,” GroupM’s Fisher said.