The best crypto accounting method will depend on the type of investor. It will also vary based on overall market conditions. FIFO can be helpful for long-term investors because it is more likely to qualify for the long-term capital gains rate, but it may also show higher capital gains. HIFO is often helpful for active traders who are unlikely to have any assets held for longer than a year. Taxpayers should also investigate the Specific Identification Method. LIFO is rarely the best choice, although there are exceptions.

Different Crypto Accounting Methods Available

Crypto (at least for now) is considered property according to the IRS. And just like when you sell any other asset, you need to calculate your cost basis when you sell it. This determines your profit and thereby the amount of tax you’re going to pay on the sale.

But there are different accounting methods you can choose from. Which one is going to be the most advantageous for your situation? Which one will allow you to pay as little tax as possible?

The answer will largely depend on the particulars of your tax situation:

- How much money are you making from crypto trading?

- What is your income from other sources?

- How long do you typically hold your crypto for before selling it?

- What are overall market conditions? Have prices been going up or going down over the past few years?

There are four basic accounting methods available: FIFO, LIFO, HIFO, and the Specific Identification Method.

FIFO (First In, First Out)

FIFO stands for First In, First Out. As the name suggests, this means that the crypto purchased first is also the crypto that is being sold first. First in (purchased) and first out (sold).

The advantage to this method is that it increases the likelihood that your sales qualify as long-term capital gains. It’s always going to pull your earliest purchase, making it more likely that you will have held it for that one year minimum. That’s significant because long-term capital gains are taxed at a maximum rate of 20% compared to short-term capital gains being taxed up to 37%.

The disadvantage is that FIFO is more likely to show a higher gain in absolute terms. Asset prices typically go up over time. So if you are pulling from the oldest transactions, you will often be pulling the transactions with the lowest cost basis.

This is partially (or in some cases, completely) offset by the much more favorable long-term capital gains rates mentioned above.

FIFO can work well for long-term, “buy and hold” investors who are likely to have crypto held for longer than a year.

LIFO (Last In, First Out)

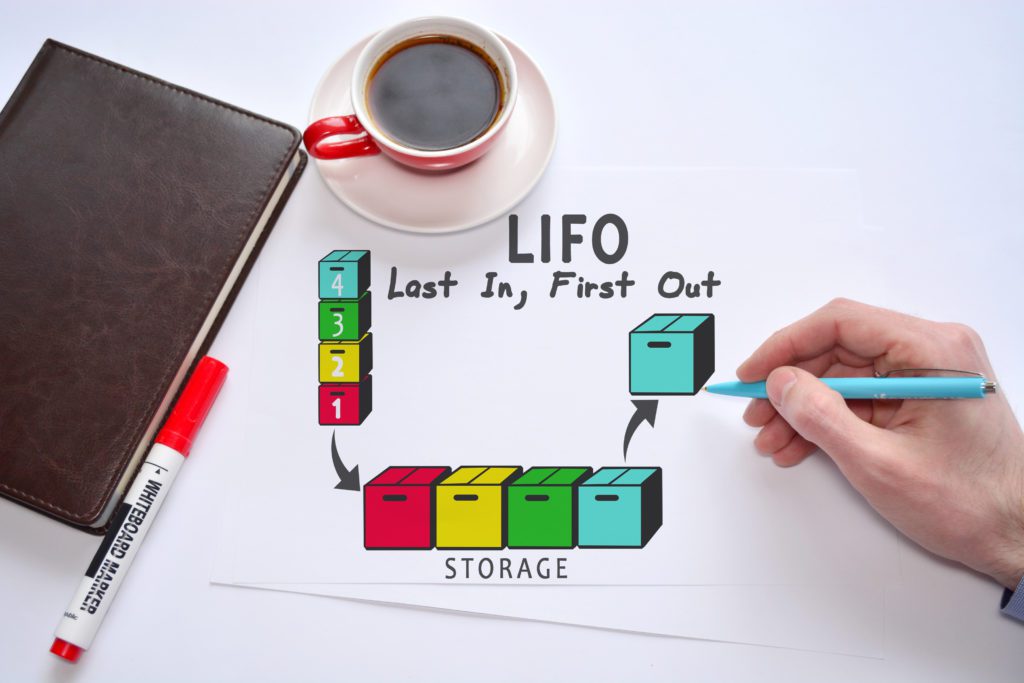

LIFO stands for Last In, First Out and is the opposite of FIFO. It assumes that whatever tokens you most recently purchased are the ones you are selling.

Since you’re always pulling the most recent transactions, LIFO gives you the worst odds of qualifying for long-term capital gains. So why would you use it?

In periods of rising prices, your most recently purchased tokens are likely to have the highest cost basis. In those instances, LIFO will show smaller gains than FIFO would.

If you are an active trader and are unlikely to qualify for long-term capital gains, LIFO will often be better than FIFO. However, there are few instances where we would recommend LIFO as HIFO is usually a better option.

HIFO (Highest In, First Out)

HIFO stands for Highest In, First Out. And as you’re probably figuring out based on the naming convention of the first two methods, it means that whatever crypto you purchased with the highest cost basis is the crypto you are selling first.

Under normal market conditions where prices are steadily rising, HIFO and LIFO will often show the same cost basis/will pull the same transactions. In many cases, the most recent transactions will be the most expensive.

But instead of leaving that to chance the way LIFO does, HIFO guarantees that you are always pulling the most expensive transactions and will show the lowest gain possible. And while long-term capital gains are not super likely with either method, HIFO does give you a better chance to qualify for them. LIFO is always pulling the most recent transaction, giving you the worst possible odds for the one year holding period. HIFO is just pulling the highest cost basis, so there is some chance that it’s crypto you held for more than a year.

HIFO is great for active traders with average holding periods of less than a year. It will give you the lowest profit, which is the primary concern when long-term capital gains are off the table.

Specific Identification Method

Possibly the best method of all of them is also the least talked about: the Specific ID method. With this method, you are manually selecting the crypto you are selling. That gives you a tremendous amount of control – both in terms of holding period and overall gain.

So why does no one talk about it?

Because its strength is also its biggest shortcoming: it is an entirely manual process. None of the existing crypto tracking software programs have Specific ID as an option. This requires you do your crypto tracking entirely on your own or take the reports from one of those programs and manually edit them. Both options are time consuming and with a higher probability of error vs. using software that is specifically designed for crypto trading. This isn’t going to be the option that makes the most sense for the majority of people.

But if you have the time, attention to detail, and are not a high-volume trader – the Specific ID method may be worth investigating. It provides you with more control than any other method, which in some cases can save you a tremendous amount of money in taxes.

Crypto Capital Gain Examples

To better illustrate, let’s run through some examples. We’re going to say that you bought 1 BTC for $20,000. A year later you bought another BTC for $50,000, and then a month after that you bought one last BTC for $40,000. A few months later you sell one of the BTC for $60,000.

How much of a gain would you show under each of the methods?

Method | Sale Price | Cost Basis | Gain |

FIFO | $60,000 | $20,000 | $40,000 |

LIFO | $60,000 | $40,000 | $20,000 |

HIFO | $60,000 | $50,000 | $10,000 |

HIFO would only show a $10,000 gain compared to a whopping $40,000 under FIFO. So HIFO is the clear winner here, right?

Maybe. Again, everything depends on the specifics of your personal situation and what other activity you have on your tax return.

Let’s say you’re a big earner and are in the top tax bracket (Note: for simplicity in this example, we’re just going to use a flat 37% for ordinary income and 20% for long-term capital gains without getting into the more complex calculations that would occur on a real return). This is what the actual tax paid would look like:

Method | Sale Price | Cost Basis | Gain | Tax Rate | Tax |

FIFO | $60,000 | $20,000 | $40,000 | 20% | $8,000 |

LIFO | $60,000 | $40,000 | $20,000 | 37% | $7,400 |

HIFO | $60,000 | $50,000 | $10,000 | 37% | $3,700 |

In this scenario, the tax bill from HIFO is less than half of the one from FIFO – even accounting for the more favorable long-term capital gains rate. That’s a big win.

But what if you had no other income aside from the Bitcoin sale? (Again, for simplicity we’re going to assume that this taxpayer’s ordinary income tax rate is 12% and aren’t going to factor in things like the standard deduction).

Method | Sale Price | Cost Basis | Gain | Tax Rate | Tax |

FIFO | $60,000 | $20,000 | $40,000 | 0% | $0 |

LIFO | $60,000 | $40,000 | $20,000 | 12% | $2,400 |

HIFO | $60,000 | $50,000 | $10,000 | 12% | $1,200 |

At that income level, long-term capital gains are taxed at 0%. It doesn’t matter that LIFO and FIFO both show lower gains, you still end up paying more because they were short-term.

But What About NFT Sales?

Let’s throw one last change in there.

Like in the last example, you had no income aside from the crypto sale. But this time, let’s say that you were selling PFP (profile picture) NFTs instead of Bitcoin. What does that look like?

Method | Sale Price | Cost Basis | Gain | Tax Rate | Tax |

FIFO | $60,000 | $20,000 | $40,000 | 12% | $4,800 |

LIFO | $60,000 | $40,000 | $20,000 | 12% | $2,400 |

HIFO | $60,000 | $50,000 | $10,000 | 12% | $1,200 |

Art NFTs are taxed as collectibles. Collectibles do not receive the same long-term capital gains treatment as other assets. They are taxed at the lesser of your ordinary income tax rate or 28%.

Conclusion: Plan With Your Crypto CPA

Some of these are admittedly somewhat unusual scenarios, but they do speak to the situation-specific nature of which accounting method is best. There is no one right or wrong answer for every taxpayer.

And the best method could change over time, even for the same taxpayer. As your circumstances change and evolve over time, you need to make sure you are planning with your CPA to you are adjusting your strategies to minimize your tax bill and maximize your cashflow. We’ve worked with clients where simply changing their accounting method has saved them hundreds of thousands of dollars in taxes.

A little planning goes a long way, so make sure you’re doing it regularly.

Any accounting, business, or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.