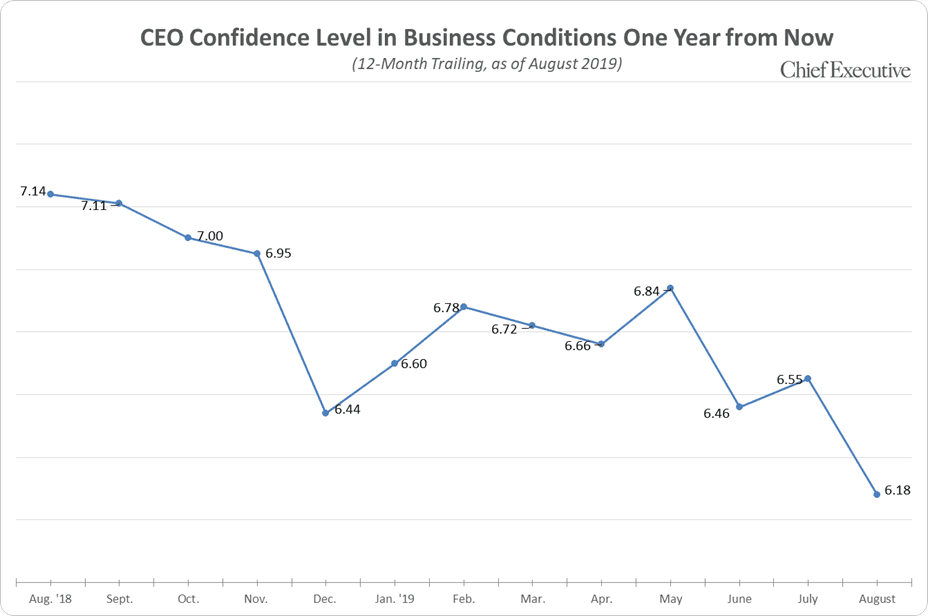

CEO confidence in future business conditions fell 6% in August from July, according to Chief Executive’s most recent polling. At 6.2 out of 10 on our 1-10 scale, confidence is at its lowest level since October 2016, the last time CEOs reported their outlook as “weak.”

CEO confidence in future business conditions fell 6% in August from July, according to Chief Executive’s most recent polling. At 6.2 out of 10 on our 1-10 scale, confidence is at its lowest level since October 2016, the last time CEOs reported their outlook as “weak.”

Confidence in current conditions also continued to slide, falling another 2% in August to 6.8/10. On the heels of another batch of tariffs, 62% of CEOs say the trade war is becoming highly detrimental to their outlook and strategy.

Chief Executive’s CEO Confidence Index is measured on a scale of 1-10. August poll had 258 responses.

Chief Executive’s CEO Confidence Index is measured on a scale of 1-10. August poll had 258 responses.

“It’s hard to predict where we’re headed with the China trade war,” says the CEO of a mid-sized wholesale company who is forecasting a weak 2020 business climate, with a rating of 5/10 on our scale. “It appears that we may be headed down a road that will not be resolved prior to the 2020 election, and I, therefore, believe that economic conditions could worsen.”

For Michael Araten, president and CEO of Philadelphia-based industrial manufacturer Sterling Drive Ventures, this is the most uncertain time in the past decade. He says his confidence is torn between the effects of the trade war and healthy consumer spending. “Consumer confidence is good right now; but I see a dip in that confidence,” he says. “In addition, companies who are or may be considering leaving China are virtually all picking other countries outside the USA. Moving a supply chain takes time and will cause disruptions to demand over the next 12-24 months.”

Adding to the disruptions and uncertainty are a tight labor market and talk of a recession. CEOs say the intensifying trade war is precipitating the economic downturn and no amount of interest rate cuts can compensate. In fact, 72% are doubtful the Fed’s policy change will succeed in sustaining the current economic cycle much longer.

Survey respondents continue to find strength in the basic economic indicators but worry that a perfect storm is brewing, with the tariffs, a shortage of talent, rising consumer and national debt levels, a volatile market, recessionary forecasts, the upcoming Presidential election and other international events such as Brexit all coming into play. They say it’s this convergence of elements that is causing the loss of confidence and retrenchment in their decision-making.

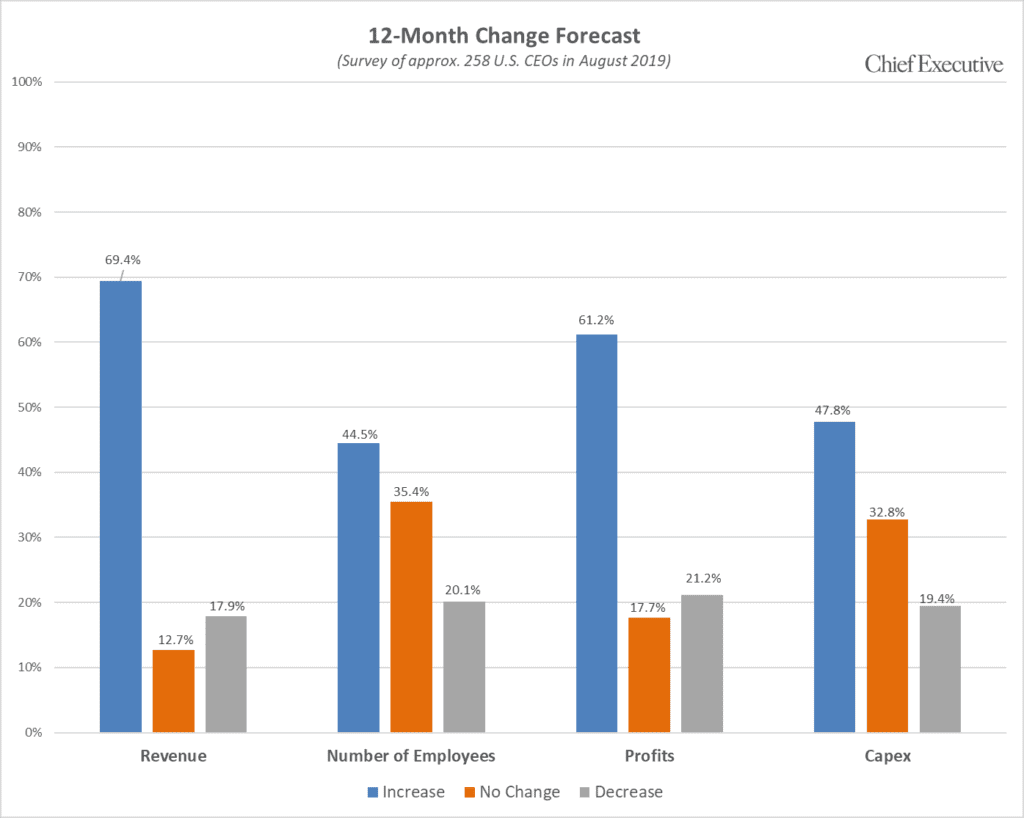

“The tariffs and economic worries are overshadowing a strong business climate,” says the CEO and president of a mid-cap technology company located in the southwest. “These things change on a weekly basis, so we’re in a teeter-totter balance scenario.” While he expects his profits and revenues to be slightly up within the next 12 months, he is not planning on adding to his workforce or increasing his expenditures in 2020.

This scenario is becoming increasingly common among business leaders, with fewer than 50% of CEOs now forecasting an increase in capital expenditures or headcount over the next 12 months. In the meantime, just 69% are anticipating an increase in revenues—a low not seen since September 2016—and just 61% are expecting profits to rise—down three percentage points this month alone.

A New Norm

A New NormSeveral CEOs say they believe the trade issues will be resolved in the short term, which they say would give the economy the boost it needs to avoid a full-on recession. Yet, for Rick Lear, CEO of Dallas-based Lear Investment Management, there won’t be a solution to the trade war.

“At first, people thought there was going to be some great moment, and Trump and Xi would shake hands and a bald eagle would land on Trump’s shoulders,” he says. “It’s not going to happen. There’s no deal to be signed because it’s not about the tariffs at all…It’s about an ideological way of life, of communism versus capitalism.”

Stephen Foley, head of Corporate Banking at TD Bank, agrees that the tariffs may be here to stay and says CEOs must plan accordingly.

“You have to adapt to this and figure out how, if the wind changes, to adjust your sails,” he says. “What first started out to be a trade skirmish is now a trade war…and I think this could be a long plot-out battle.”

He says until now, consumers haven’t really been impacted by the tariffs, and spending remains very strong in the U.S., but he predicts that because the latest wave targets more consumer products, things may change.

“So far, companies have been willing to eat those costs and not pass them on to the consumer, which has kept the consumer very active,” he says. “But the more this hits the consumer, I think then we should begin to worry.”

Some CEOs agree that this all may take several years to resolve or to, at least, culminate to a more stable environment.

“Until then, uncertainty is causing businesses to hold off on substantial capital expenditures, which, in turn, will result in a lagging slowdown in GDP that won’t show up for another 8-16 months,” says one respondent at a large transportation company who, despite having a weak outlook (4/10), says the Federal Reserve’s policy change could ultimately help lead us to a softer landing.

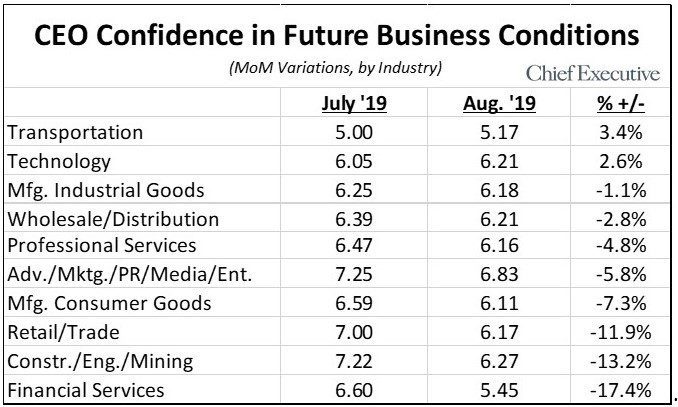

Only two sectors gained confidence in August: transportation and technology. While CEOs in those industries report the same concerns over the current uncertainty and headwinds ahead, they say demand remains strong and pipelines are healthy.

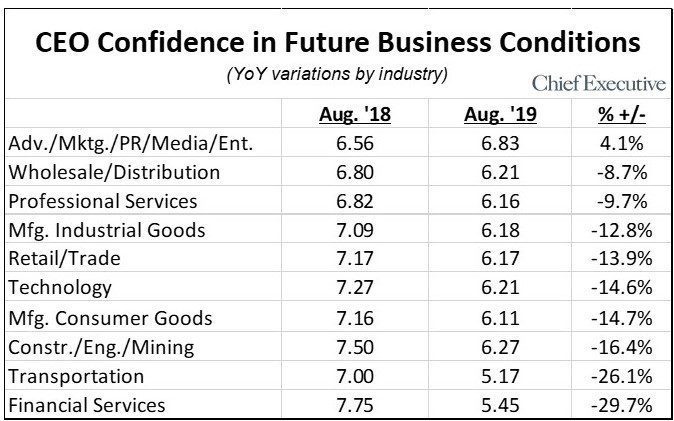

Looking at year-over-year confidence levels, all sectors except advertising/media/PR/entertainment are down—the majority by double digits. Year-to-date is a similar story, with advertising the only sector in positive territory.

Looking at the evolution of CEO confidence by company size tells a similar story, with all peer groups showing double-digit declines since the same time last year.

The same is true when looking at the month-over-month change, albeit to a lesser degree, as the issues on CEOs’ minds are affecting all peer groups.

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components.

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.